Utz Brands (UTZ)·Q4 2025 Earnings Summary

Utz Brands Delivers Strong EBITDA Growth as Retail Sales Outpace Category

February 3, 2026 · by Fintool AI Agent

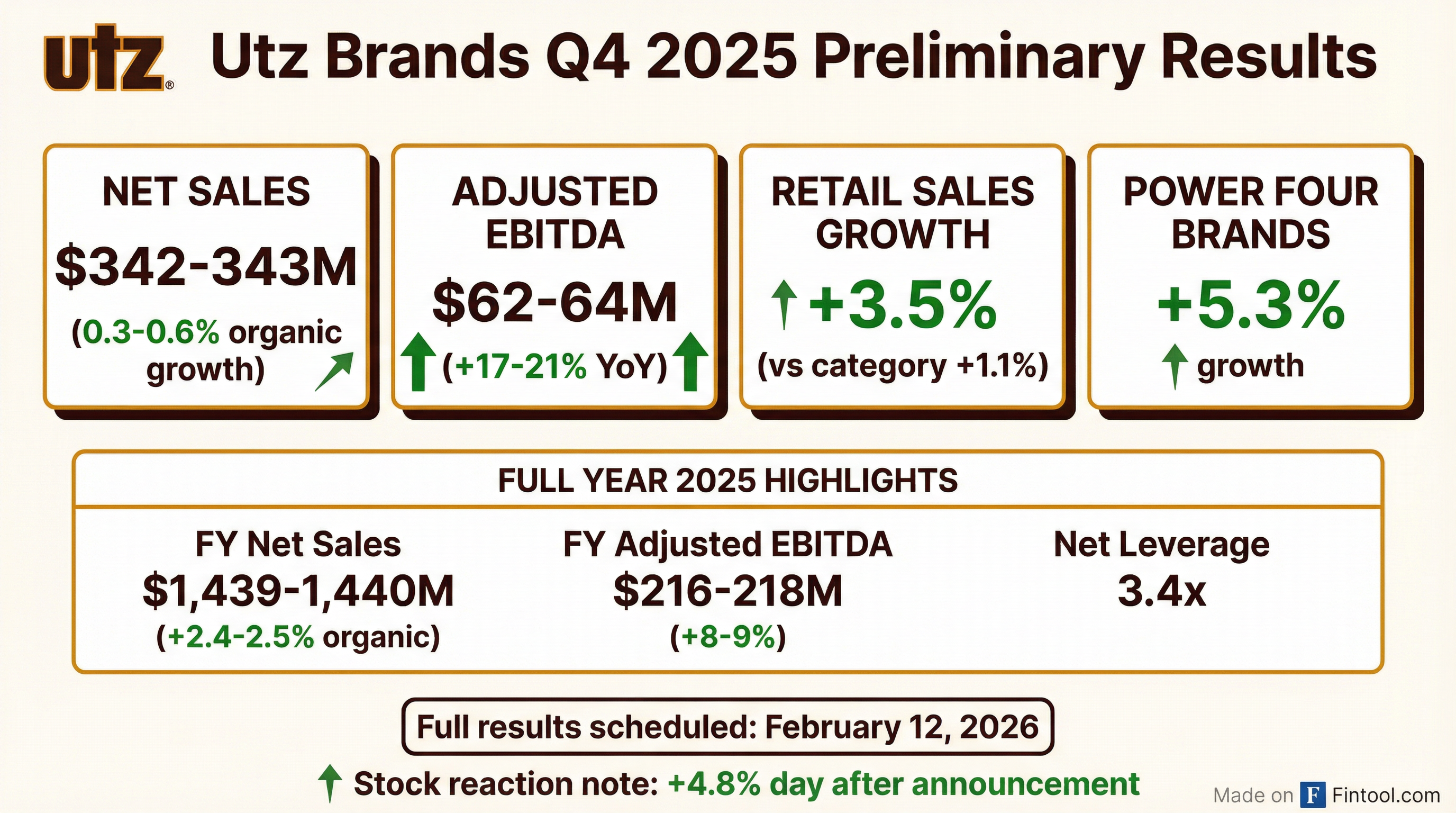

Utz Brands (NYSE: UTZ) announced preliminary Q4 2025 results showing continued momentum in margin expansion and retail outperformance. Adjusted EBITDA grew 17-21% YoY despite modest organic net sales growth of 0.3-0.6%, reflecting successful productivity initiatives.

The stock rallied 4.8% the day after the January 12 preliminary announcement, as investors rewarded the company's margin progress and category outperformance.

What Were the Key Numbers?

Full Year 2025:

Why Did Net Sales Lag Retail Sales?

CEO Howard Friedman addressed the gap between strong retail performance (+3.5%) and modest net sales growth (+0.3-0.6%): channel partners reduced inventories during the second half of Q4 due to SNAP payment delays and the government shutdown.

"Shipment trends normalized as we exited the year." — Howard Friedman, CEO

This is a temporary timing issue rather than demand weakness. The company's branded salty snacks retail sales surpassed $1.8 billion for full year 2025.

How Did the Stock React?

The stock showed a muted reaction on the announcement day (January 12: +0.8%) but surged +4.8% the following day as investors digested the strong EBITDA performance and category outperformance narrative presented at the ICR Conference fireside chat.

The stock has gained ~7% since the preliminary announcement, recovering from its 52-week low of $9.15.

Did the Power Four Brands Deliver?

The Power Four brands (Utz, On The Border, Zapp's, Boulder Canyon) grew retail sales 5.3% in Q4, significantly outpacing both the company's total branded portfolio (+3.5%) and the salty snack category (+1.1%).

For full year 2025, Power Four brands grew 5.0%, demonstrating consistent execution across the portfolio.

Key brand highlights from Q3 2025 earnings call context:

- Boulder Canyon: Number one potato chip brand in the natural channel, with ACV of ~52% vs. Utz flagship at 80%+ — significant distribution runway ahead

- On The Border: Experienced some regional softness from value-seeking consumers, but management believes issues are short-term and correctable

What's the Margin Expansion Story?

Utz has been executing on its Investor Day commitment to reach ~16% Adjusted EBITDA margins. The Q4 2025 implied EBITDA margin of ~18% (midpoint $63M / $342.5M) shows meaningful progress.

*Values retrieved from S&P Global

CFO BK Kelley emphasized: "The Company made significant progress on Adjusted EBITDA Margin expansion in the fourth quarter and throughout 2025. Our strong improvement in cash generation allowed us to exit the year at approximately 3.4x Net Leverage."

This deleveraging progress (from higher levels historically) supports the company's long-term capital allocation flexibility.

What Changed From Last Quarter?

Continued momentum:

- Retail sales outperformance sustained (3.5% vs. category 1.1%)

- EBITDA margin expansion accelerated (17-21% EBITDA growth on flat revenue)

- California expansion on track for early 2026

New this quarter:

- Accounting reclassification: Effective Q4 2025, Utz moved logistics, DSD distribution center, and outbound shipping costs from Selling to Cost of Goods Sold. This improves comparability with peers but does not change EBITDA, Net Income, or EPS.

- Channel destocking: Inventory reductions by retailers due to SNAP delays and government shutdown created temporary net sales headwind

What to Watch on February 12?

Utz will report full Q4 and FY 2025 results and provide 2026 guidance on February 12, 2026. Key areas to monitor:

-

2026 guidance: Management previously targeted 16% EBITDA margins and 200-300 bps above-category growth. California expansion investments may impact near-term margins.

-

California launch details: Route acquisition integration progress and early retail wins

-

Innovation pipeline: Management hinted at addressing protein, non-seed oil, and portion control trends

-

On The Border recovery: Whether corrective actions have stabilized the brand

Historical Beat/Miss Performance

*Values retrieved from S&P Global

Utz has consistently delivered EPS beats while revenue has been mixed, reflecting the company's focus on profitability improvement over top-line growth.

Related: